ADA Price Prediction: How High Will Cardano Go in Q4 2025?

#ADA

- Technical Positioning: ADA is testing critical support at the lower Bollinger Band while showing positive MACD divergence

- Market Sentiment: Seasonal patterns favor Q4 performance, but meme coin distraction presents headwinds

- Fundamental Backdrop: Strong developer activity contrasts with short-term price pressure, creating potential for catch-up movement

ADA Price Prediction

ADA Technical Analysis: Key Levels to Watch

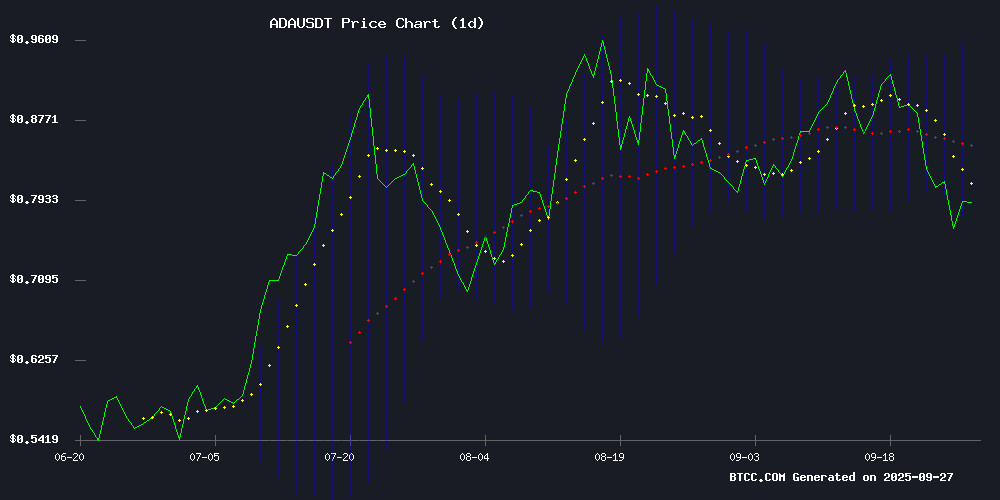

According to BTCC financial analyst Michael, ADA is currently trading at $0.7839, below its 20-day moving average of $0.8638, indicating short-term bearish pressure. The MACD shows a positive histogram of 0.03309, suggesting potential upward momentum despite the price sitting NEAR the lower Bollinger Band at $0.7674. "The convergence of price near the lower band while MACD remains positive creates an interesting technical setup," Michael notes. "A hold above the $0.767 support could trigger a move toward the middle Bollinger Band at $0.8638."

Market Sentiment: ADA Faces Critical Juncture

BTCC financial analyst Michael observes that while Cardano's developer activity remains strong, the current market attention has shifted toward meme coins. "The fundamental strength in Cardano's ecosystem contrasts with short-term market sentiment," Michael states. "Seasonal patterns historically favor Q4 rallies, but ADA must first defend its key support level. The Remittix project gaining attention could divert capital temporarily, but Cardano's technical foundation suggests resilience."

Factors Influencing ADA's Price

Cardano's ADA Faces Key Support Test as Remittix Gains Investor Attention

Cardano's ADA hovers near critical support at $0.8134 after repeated rejections at the $0.90 resistance level. Market participants anticipate a potential rebound toward $0.85-$0.87 if current support holds, though failure could see a dip to $0.78. The network's proposed $41 million liquidity fund for DeFi and RWA tokenization adds fundamental weight to technical considerations.

Meanwhile, PayFi project Remittix continues attracting capital, having raised $26.7 million through token sales. Its dual utility as a payment solution and yield-bearing asset positions RTX as a competitive alternative for ADA holders seeking tangible use cases. The market appears increasingly bifurcated between established layer-1 tokens and emerging utility protocols.

Cardano (ADA) Tests Critical Support as Seasonal Patterns Hint at Q4 Rally

Cardano's ADA token is exhibiting familiar seasonal tendencies, with historical data suggesting potential for a year-end surge despite current market weakness. The digital asset currently trades 15% below its January opening price, testing crucial support near $0.80-$0.81—a level market technicians identify as make-or-break for near-term price action.

October-November has historically served as ADA's launching pad, with 2023 delivering a 140% rally and 2024 posting 35% gains during this window. Institutional interest continues building, evidenced by Reliance Global Group's recent treasury allocation to Cardano. Technical charts suggest possible short-term pressure toward $0.75 before any late-year upside attempt toward the $1.50 resistance zone.

Cardano’s Developer Momentum Contrasts With Meme Coin Frenzy

Cardano's ecosystem demonstrates robust developer activity with over 1,600 governance proposals submitted through its CIP framework, reinforcing its reputation as a builder-focused blockchain. The network continues to evolve with infrastructure upgrades, including staking pool optimizations and Hydra scaling enhancements.

Meanwhile, presale traders are diverting attention toward high-risk, high-reward meme tokens like MAGAX, which promises astronomical 19,900% returns. This divergence underscores the crypto market's dual nature: methodical platform growth versus speculative retail plays.

ADA tests key support at $0.80 as Project Catalyst allocates $18.2 million in development funding. The contrast between Cardano's measured progress and meme coins' viral potential highlights shifting capital flows in digital asset markets.

How High Will ADA Price Go?

Based on current technical indicators and market sentiment, BTCC financial analyst Michael provides this outlook for ADA:

| Scenario | Price Target | Probability | Key Levels |

|---|---|---|---|

| Bullish | $0.96-$1.10 | 35% | Break above 20-day MA |

| Neutral | $0.77-$0.86 | 45% | Hold lower Bollinger Band |

| Bearish | $0.65-$0.75 | 20% | Break below $0.767 support |

"The most likely scenario involves ADA consolidating between $0.77 and $0.86 through October," Michael explains. "A successful test of the lower Bollinger Band could set the stage for a Q4 rally toward the $0.96 resistance. However, the market needs to see sustained developer activity translate into user adoption."